Monday, May 1, 2023

Saturday, April 29, 2023

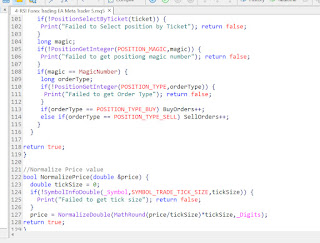

Its very simple 45 Lines Source code with Money flow index indicator strategy. Its tested with demo account for Coding Learning purpose. Use it for your MT5 robot program education.

Money Flow Index Expert Advisor Full Robot Code Meta Trader 5 EA

By: Forex Trader on: 4:45 AMFriday, April 28, 2023

Thursday, April 27, 2023

Wednesday, April 26, 2023

Tuesday, April 25, 2023

Full program step by step code learning images given . first one is full code. its working fine in demo account and its for education purpose only.

learn the MT5 program coding and Earn good .

MT5 - Moving Average cross trade full program with steps

By: Forex Trader on: 3:40 AMSunday, April 23, 2023

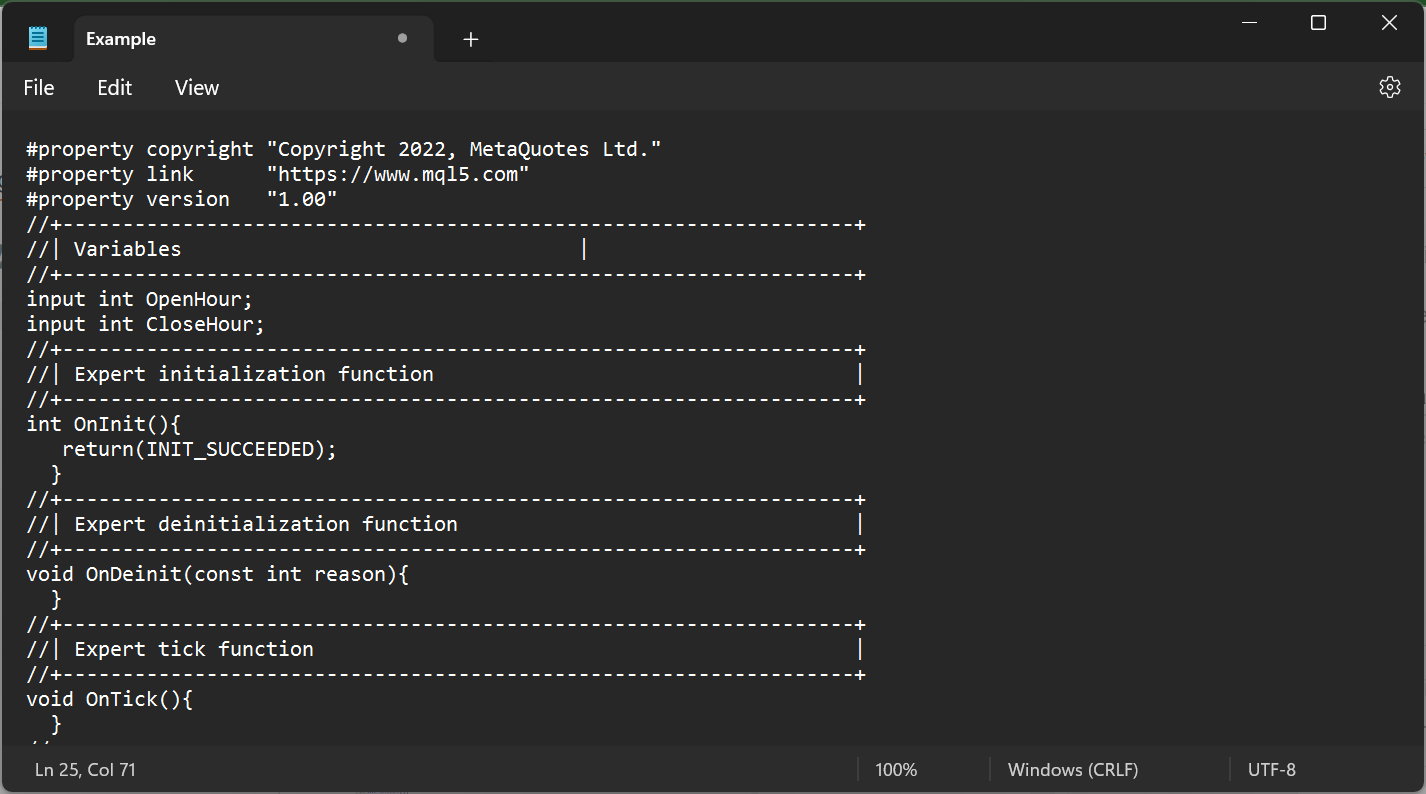

Step to step writing notes to learning MT5 EA programming.

Step 1- Its basic 20 lines given by MQL5 New EA templates, So just keep the below 20 lines and Delete balance unwanted lines to keep simple.

#property copyright "Copyright 2022, MetaQuotes Ltd."

#property link "https://www.mql5.com"

#property version "1.00"

//+------------------------------------------------------------------+

//| Expert initialization function |

//+------------------------------------------------------------------+

int OnInit(){

return(INIT_SUCCEEDED);

}

//+------------------------------------------------------------------+

//| Expert deinitialization function |

//+------------------------------------------------------------------+

void OnDeinit(const int reason){

}

//+------------------------------------------------------------------+

//| Expert tick function |

//+------------------------------------------------------------------+

void OnTick(){

}

//+------------------------------------------------------------------+

now fresh writing starting for our TimeTrader. in here program concepts is Opening order in Particular time and Closing order in Particular time. Example open order in 10 O clock and Close it in 3 hours later 13 O'clock. In here order open time and closing time is our input decision. So first we take it in code.

Step 2 : add the belw five lines in previous code as Line as 4,5,6,7,8. Now confirm total lines 25.

//+------------------------------------------------------------------+

//| Variables |

//+------------------------------------------------------------------+

input int OpenHour;

input int CloseHour;

Step 3- We need predefined trading functions for Easy programming, So add the include function call. New lines added in 4,5,6 and 7. 7th line only actual program line and balance 3 lines are comments for easy reading. now total lines 29.

Step 4- Now additional variable added in below 12th line for trade call, check in image and add that 13th line program, now total 30 lines.

Step 5- Now added time hour converstion and trade condition call lines in above image. new 10 lines added below 28th line. firs to line for fixing time and next if loop for matching the input hour and is there order running or not. is it no order and time is match then new order will open, thats same is match the close hour and its any running order, then it will get close if second loop matched.

MT5 EA programming learning from zero

By: Forex Trader on: 10:52 PMSaturday, April 22, 2023

Sunday, April 16, 2023

Tuesday, March 21, 2023

Danske Bank economists maintain their strategic case for a lower EUR/USD , predicting the pair to reach 1.02 in the next six-to-twelve months. They argue that this will be driven by tighter financial conditions, relative rates, and asset demand, along with new energy and real rate shocks. In this article, we will explore Danske Bank's reasoning for this forecast and the potential implications for traders and investors.

Introduction

The EUR/USD has been trending downwards, with the pair currently trading at around 1.19. Danske Bank economists have long predicted a strategic case for a lower EUR/USD , citing factors such as relative terms of trade, real rates, and relative unit labour costs. However, they now also see the potential for a short-term dip in the currency pair due to tightening financial conditions, relative rates, and asset demand.

Factors Driving the EUR/USD Forecast

Danske Bank's forecast for a lower EUR/USD is based on a combination of long-term and short-term factors. These include:

Relative Terms of Trade

Danske Bank economists argue that the Eurozone's terms of trade have been deteriorating relative to the US. This is due to the EU's high dependence on exports and a less competitive manufacturing sector compared to the US. As a result, the bank expects the EUR/USD to trend lower over the long term.

Real Rates and Growth Prospects

Danske Bank also believes that real rates and growth prospects are more favorable in the US than in the Eurozone. The bank notes that the US has outperformed the Eurozone in terms of GDP growth, and that US real rates are higher. This gives the US a relative advantage, which is likely to drive down the value of the EUR/USD .

Relative Unit Labour Costs

Finally, Danske Bank argues that relative unit labour costs are also more favorable in the US than in the Eurozone. This is due to factors such as wage growth and productivity. As a result, the bank expects the EUR/USD to trend lower over the long term.

Tightening Financial Conditions

In addition to these long-term factors, Danske Bank also cites tightening financial conditions as a potential driver of a short-term dip in the EUR/USD . The bank notes that financial conditions have already tightened recently, but expects more tightening to come. This could be driven by factors such as relative rates and asset demand.

New Energy/Real Rate Shocks

Finally, Danske Bank notes that a return to the September lows would require new energy and real rate shocks. While these are difficult to predict, they could have a significant impact on the EUR/USD .

Implications for Traders and Investors

For traders and investors, Danske Bank's forecast for a lower EUR/USD has important implications. Firstly, it suggests that long positions in the EUR/USD may be less favorable than short positions. Secondly, it suggests that traders and investors should be cautious about entering long positions in Eurozone stocks and bonds.

Conclusion

Danske Bank's economists maintain their strategic case for a lower EUR/USD , predicting the pair to reach 1.02 in the next six-to-twelve months. This forecast is based on a combination of long-term factors such as relative terms of trade, real rates, and relative unit labour costs, along with short-term factors such as tightening financial conditions and potential new energy and real rate shocks. For traders and investors, this forecast suggests that short positions in the EUR/USD may be more favorable than long positions, and that caution should be exercised when investing in Eurozone stocks and bonds.

EURUSD chart short

By: Forex Trader on: 5:32 AMThursday, March 16, 2023

Wednesday, March 15, 2023

A lot of talk on who is to blame for the SVB Financial collapse – this is the first big casualty of rapid rate hikes and tighter policy, but who is to blame and what are the next steps?

-SVBs management – they invested short-term deposits in longer term fixed income assets – where a large % of its $120b securities portfolio lacked any kind of interest rate hedge (payers swaps were clearly needed)

-SVBs management – In the past 8 months SVB had no risk manager - fortune.com/2023/03/...-chief-risk-officer/ - no one knows how they efficiently managed risk

-SVBs management – the accounts showed they held $91b of its $120b securities in its HTM (assets Held to Maturity) book – these are assets they intend to hold until maturity but the accounting rules detail, that they don’t need to mark-to-market the moves in the underlying and report the ballooning losses – which again were not hedged.

-SVB deposit mix - 93%+ were above the FDIC insurance limit – this makes depositors v sensitive to any capital concerns at the bank

-SVB deposit mix - VCs had a rapid cash burn, as projects they back are typically driven by changes in interest rates (think Net Present value and Internal rates of return) – depositors took cash off SVB’s balance sheet to fund operations – SVB subsequently had to sell assets as their liabilities fell – we then see realised losses from buying securities at much higher prices.

-Short sellers/investor base – shorts had an eye on unrealised losses from the worsening asset quality for weeks – the selling accelerated when the CEO/ CFO /CMO disclosed they’d sold a chunk of stock on 27 March – it was over when the SVB took a $1.8b hit on its AFS securities available for sale on Wednesday – management sold $21b of its $28b book and announced a $2.25b in equity/debt raising - investors knew with conviction that depositors were fleeing – who supports a raising when liabilities are falling – no one sensible, raising pulled

-The Fed - failing to know such a shift in rates would impact banks asset quality when its primary function is financial stability.

-Regulation - Basel 3 - banks being forced to buy govt paper against deposits - v low risk weighting (perhaps required a hedge

Hard to pinpoint this on one aspect IMO - I think there is a perfect storm going on – a lack of hedging of interest rate risk was clearly a dominant factor behind this. Top down this is a function of rapidly tightening monetary policy and the impact this had on both the asset quality and liability side of the balance sheet – we should recall SVBs model is not the same as others in the banking space, so its hard to say this is systemic – still we wait for the outcome on next steps on how deposits over $250k will be dealt with – we’re hearing they may get 50% back initially but a buyer would be the best solution

The issue for regional/smaller banks comes if is we see some sort of haircut on the deposits claim over $250k – that could see a loss of confidence in holding deposits with other smaller banks names – we shall hear more soon, but broad contagion through the financial system seems unlikely, but it is a possibility given nearly 1/3 deposits in the banking system are uninsured – any bank with a large asset base and low equity are in the spotlight

As said Friday this could be a nothing burger or have real impactions on economics - the big issue happens this week if we see no clarity on how depositors are dealt (seems unlikely) with and we get a hot CPI print

Financial collapse

By: Forex Trader on: 9:41 AMTuesday, March 14, 2023

GBPUSD broke out of the descending channel .

Price action created a bearish harmonic pattern .

The market reached the psychological level at 1.22000 and the structure resistance level.

If price prints a double top at the resistance level , then it is likely to test the support level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

GBPUSD trading chart

By: Forex Trader on: 6:14 PMHello traders ,what do you think about USDJPY ?We expect this pair to drop at least to the specified zone after the pullback to the broken level.

If this post was useful to you, do not forget to like and comment.❤️USDJPY trade short

By: Forex Trader on: 6:12 PMMonday, March 13, 2023

Hy dear Members . Hope you all are enjoying our ideas and analysis. Now we are here to discuss about GBPUSD . GBPUSD is breaking falling Wedge Pattern. And this wedge indicates that we will get a Bullish wave after this.

Here it has maximum Chances we can see a good Bullish wave.

We can see price around 1.27 soon. As this is daily chart so we can see small Retesting but overall we will see a good Bullish wave. Keep in touch we will update further soon.

GBPUSD trading

By: Forex Trader on: 9:10 PMSunday, March 12, 2023

Popular Posts

-

யூடியூப் தளத்தினை நடத்திவரும் கூகுள் கம்பெனி, யுடியூப் தளத்தில் விடியோக்களை பதிவேற்றுவதன் வாயிலாக பணம் சம்பாதிப்பதற்கான வாய்ப்பினை பல வரு...

-

சுமார்ட்டா சிந்திக்கச் சொல்லிக் கொடுக்க ஆயிரம் நிறுவனங்கள், அவர்களுக்கு பக்கப்பலமாக ஆயிரம் ஆயிரம் நிறுவனங்கள் என ஒன்றுக்கு ஒன்றுக்கு இணைப்...

-

தங்கத்தின் விலை சமீப நாட்களில் கரடிக்கு வாய்ப்பாக அமைந்திருப்பது பலருக்கும் அடுத்தக்கட்ட உயர்வு எப்பொழுது தொடங்கும் என்று எதிர்பார்ப்பு அதி...

-

Real Time Economic Calendar provided by Investing.com Follow the Three Bull Symbol Report Time and Trade Carefully. Because the high i...

-

பணம் சம்பாதிப்பது என்பது அனைவருக்குமான அத்தியாவசிய தேவையாகிவிட்டது. அதைப்போல், 50% நபர்கள் பணம் சம்பாதித்துக் கொண்டிருப்பார்ப்பார்கள் என்பது...